The retail and leisure sector records first fall in vacancy rates since 2018

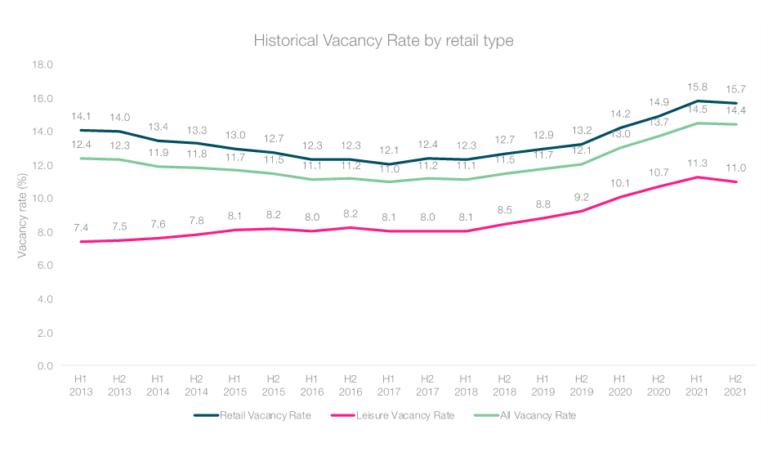

In 2021, after rising steadily for three years the vacancy rate for the retail and leisure sector in the UK hit a record high in the first half of the year of 14.5%, according to the latest date released by Local Data Company (LDC), which covers the full year of 2021. In the second half of 2021, however, there was marginal drop in the vacancy rates of 0.1% suggesting that the worst of the pandemic’s impact might be over.

Lucy Stainton, commercial director at Local Data Company, says that the latest results are cause for ‘cautious optimism’ as the number of empty shops are finally coming down as consumers return to high streets and centres.

“Our analysis points towards this trend continuing as the final shakeout from various CVAs and insolvencies is hopefully behind us and independent operators continue to open new sites,” says Stainton. “With many chains re-looking at their strategy for growth, the independent sector proving buoyant and an unprecedented level of repurposing and redevelopment, we could be seeing the start of a new phase of physical retailing and we will be tracking this very closely.”

The marginal decline of 0.1% in H2 marks the first fall in Britain’s vacancy rate since H1 of 2018. Whilst the national vacancy rate rose by 0.7% for the whole of 2021 year-on-year, the slight drop in the second half marks a change in the tide for the retail and leisure sectors.

The retail vacancy rate hit a record high in 2021, peaking in the first half of the year at 15.8% before experiencing a 0.1% decrease in H2. The retail vacancy rate now sits at 15.7% – a figure according to LDC that looks set to decline further as more units are taken off the market for repurposing and as retailers return to acquiring new sites.

The leisure sector saw even more promising signs of recovery as the leisure vacancy rate dropped from 11.3% to 11.0% in H2 2021 – the largest decrease since records began in H1 2013. Expanding chain and independent F&B operators bolstered growth as pent-up demand from the various lockdowns and the return of office workers later in the year provided a further boost to hospitality venues.

Shopping centres saw a reduction in vacancy rate of 0.3%, bringing the shopping centre vacancy figure back down to 19.1% at the end of 2021. Retail parks saw a 0.2% decline in vacancy rate in the second half of 2021, maintaining lowest vacancy rate of any location type since 2013. High streets continued to prove more stable than other location types where the vacancy rate fell by 0.1% in H2 2021.

Stainton added that whilst vacancy rates are not expected to return to pre-pandemic levels yet, they are projected to continue falling throughout 2022 due to the continued redevelopment and repurposing of retail space, suggesting that the worst of the pandemic-related closures is over and the industry has shifted its focus from survival to recovery.

This was first published in Retail Destination Fortnightly. Click here to subscribe.