Knight Frank’s H1 2022 Retail Investment report shows that shopping centre investment volumes totalled £1.24bn in the first half of 2022, up from £460m in the same period in 2021, with total investment for the year set to return to the 10-year average.

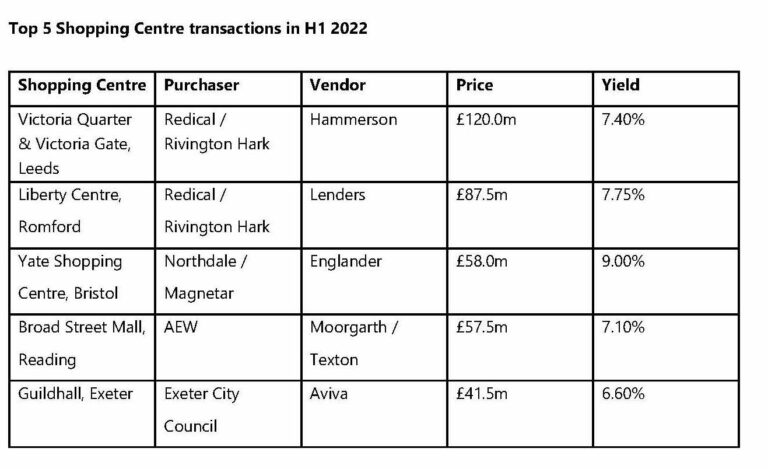

According to the analysis, investor demand has been focused on smaller in-town shopping centres, as well as a handful of larger ‘destination’ malls, including the £120m combined purchase of Victoria Gate and Victoria Quarter in Leeds by Switzerland-based Redical Capital. A number of larger assets are expected to come to market in the second half of the year.

Activity in the first half of the year has been driven by overseas and private equity investors, alongside institutional investment into the outlet sector. The demand has seen yields tighten for the first time since 2015, with larger regional shopping centres now trading at 7.5%, down from 8% in 2021, and local centres trading at 9%, compared with 10% last year.

The first half of 2022 has seen over £3.2bn invested in retail property in total, with strong competition continuing for retail warehousing, which accounted for £1.28bn, £272m invested in high street retail, and £415m committed for food stores.

Will Lund, partner, Retail Capital Markets, Knight Frank, said: “After years of falling valuations we are seeing a shift in investor sentiment and shopping centres starting to come back into fashion. There was an artificial spike in e-commerce during the pandemic but spending habits are now normalising. With pricing and rents now stabilising, investors are beginning to see the long-term appeal and resilience of shopping centres as a key part of modern multichannel retail. We expect a number of regional centres to come to market in the second half which will test demand for larger lot sizes.”

Sam Waterworth, partner, Retail Capital Markets, Knight Frank, added: “It is not just shopping centres that are more in-demand, we are currently seeing strong appetite for most types of retail property, despite the economic headwinds. Competition for retail warehousing, which has outperformed almost any other property asset class in the past year, is fierce and we are seeing more liquidity in high street retail, particularly in the South East. After surviving the challenges posed by the pandemic there is renewed confidence that retail will endure the market turbulence expected in H2 2022 and provide attractive returns going forwards.”